Web Payments Phase 1

The initial implementation of the Web Payments work will start in October 2015

and will focus on delivering standards for a Minimum Viable Platform (MVP)

by December 2017.

Goals

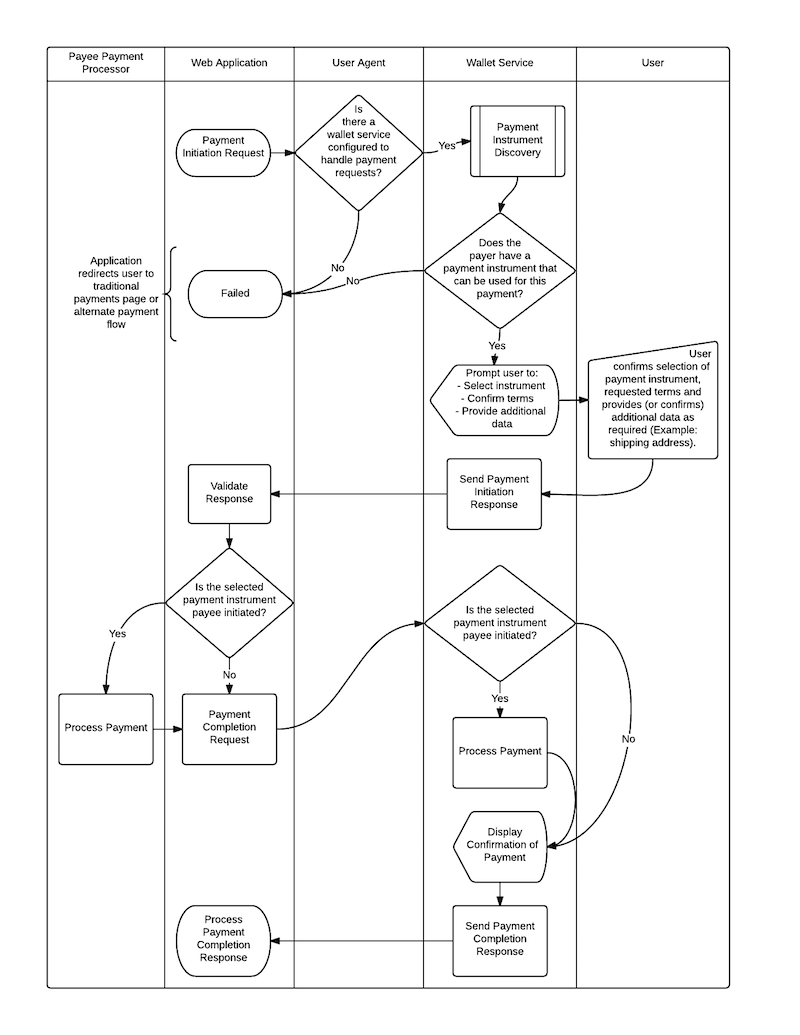

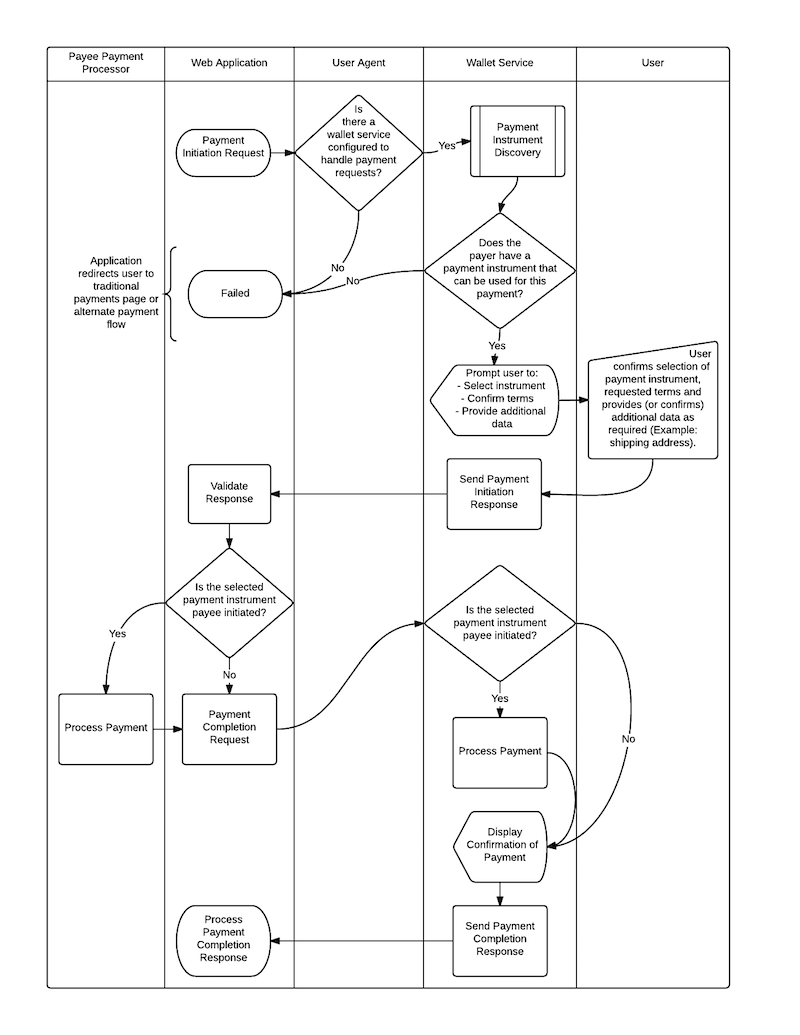

The scope of work supports the following elements of a basic purchase

triggered by user interaction with a Web application initiating a new

payment. These standards define a high-level message flow for a payment

from payer to payee either in the form of a credit push (payer

initiated) or a debit pull (payee initiated) payment, and can be used to

facilitate a payment from any payment scheme.

- Pre-Payment

-

- Registration, by the payer with their

wallet, of any conforming payment

instrument they wish to use on the Web (e.g. a credit or

debit card, electronic cash, cryptocurrency, etc).

- Negotiation of Terms

-

- Payment Initiation Request, by the payee to

the payer providing the terms of the payment including elements

such as the accepted payment schemes, price, currency, recurrence,

transaction type (purchase, refund etc.), timeout and requests for

any additional data that is required from the payee.

- Negotiation of Payment Instruments

-

- Discovery, by the payer, of their available

payment instruments that can be used to make the payment. This is

done by matching those registered by the payer with those

supported by the payee (as defined in the Payment Initiation

Request), while keeping information local to the payer.

- Selection of a payment instrument by the

payer, confirmation of the terms, and sending of any requested

data back to the payee for validation.

- Payment Processing and Completion

-

- Execution of the payment by either payer or payee.

- Delivery of a Payment Completion generated by

the entity that executed the payment. This may contain a

Proof of Payment if supported by the payment

scheme.

The group will also address exceptions that may occur during these

steps, including payment authorization failure.

Use Cases

The following use cases are in scope for phase 1 with specific limitations

expressed beside each use case:

The capabilities associated with each use case listed above can be found in

the

Web Payments Capabilities 1.0 document.

Groups and Scope

A list of relevant groups that will participate in the first iteration of

specification creation.

| Group |

Scope |

Charter |

|

Web Payments Interest Group

|

Continued development of use cases and requirements for phase 2.

Liason between larger W3C community and other relevant standards bodies.

|

October 2014 - December 2017

|

|

Web Payments Working Group

|

Invoking a payment request, selecting a payment instrument, initiating funds

transfer, delivering a proof of payment.

|

Draft Charter

|

|

Web Authentication Working Group

|

Secure authentication of entities (users, systems and devices) to enable

high-security Web applications. Based on FIDO Alliance work.

|

No charter yet

|

|

Hardware-based Security Working Group

|

A set of Hardware-Based Web Security standard services providing Web

Applications usage of secure services enabled by hardware modules

(Trusted Execution Environments, Secure Elements, and other secure enablers).

|

No charter yet.

|

It is currently unknown whether or not a Credentials WG or Linked Data

Security WG will be created.

Related W3C Groups

-

Technical Architecture Group (TAG) (for reviews related to Web Architecture)

-

Security IG (for reviews about security)

-

Privacy IG (for reviews about sharing of sensitive information)

Related W3C Community Groups

-

Credentials

-

Web NFC

-

Web Payments

-

Web Bluetooth

-

Web Crypto API

-

Web of Things

Deployment and Adoption

Deployment in phase 1 will focus on enabling a few major online retailers

to run Web Payment agents to issue Web Payment invoices for processing at

1-2 major online Payment Service Providers (or banks). The payment

institutions would then initiate the payment and send a proof of payment

back to the retailer.

Goals

-

3 major online retailers launching Web Payments support (for example:

Alibaba, Walmart, Target, Best Buy, Overstock.com, Amazon, Tesco, eBay, etc.)

-

1-2 large online payment companies (or banks) launching Web Payments support

(for example: Google Wallet, PayPal, Alipay, Bank of America, HSBC,

US Fed, etc.)

-

5-10 smaller players from the online retail space and the payments space

-

1 million payments within the first year after standardization

-

Favorable reviews by the Web developer community

Strategies

-

Deployment strategy should be a pure software deployment. Do not require new hardware to be deployed.

-

Specifications should focus on technology that has already been prototyped.

-

All software should be cloud-only for phase 1. For example, do not try to

support both cloud and local wallets due to a possible conflict around the

"payment message bus" being implemented at the OS layer or the browser layer.

Unresolved Issues

Where we need an extensible message format, we will want to specify at least

a data model. The hard question will be whether we can achieve a single

serialization (e.g., JSON or JSON-LD or XML) or whether we need multiple.

What canonicalization (if any) is needed in our messages for the purpose of

digital signatures.